Freedom Chasers Capital is committed to investing with a purpose. What’s that purpose? To provide freedom to their investors through cash-flowing and wealth-building real estate investments.

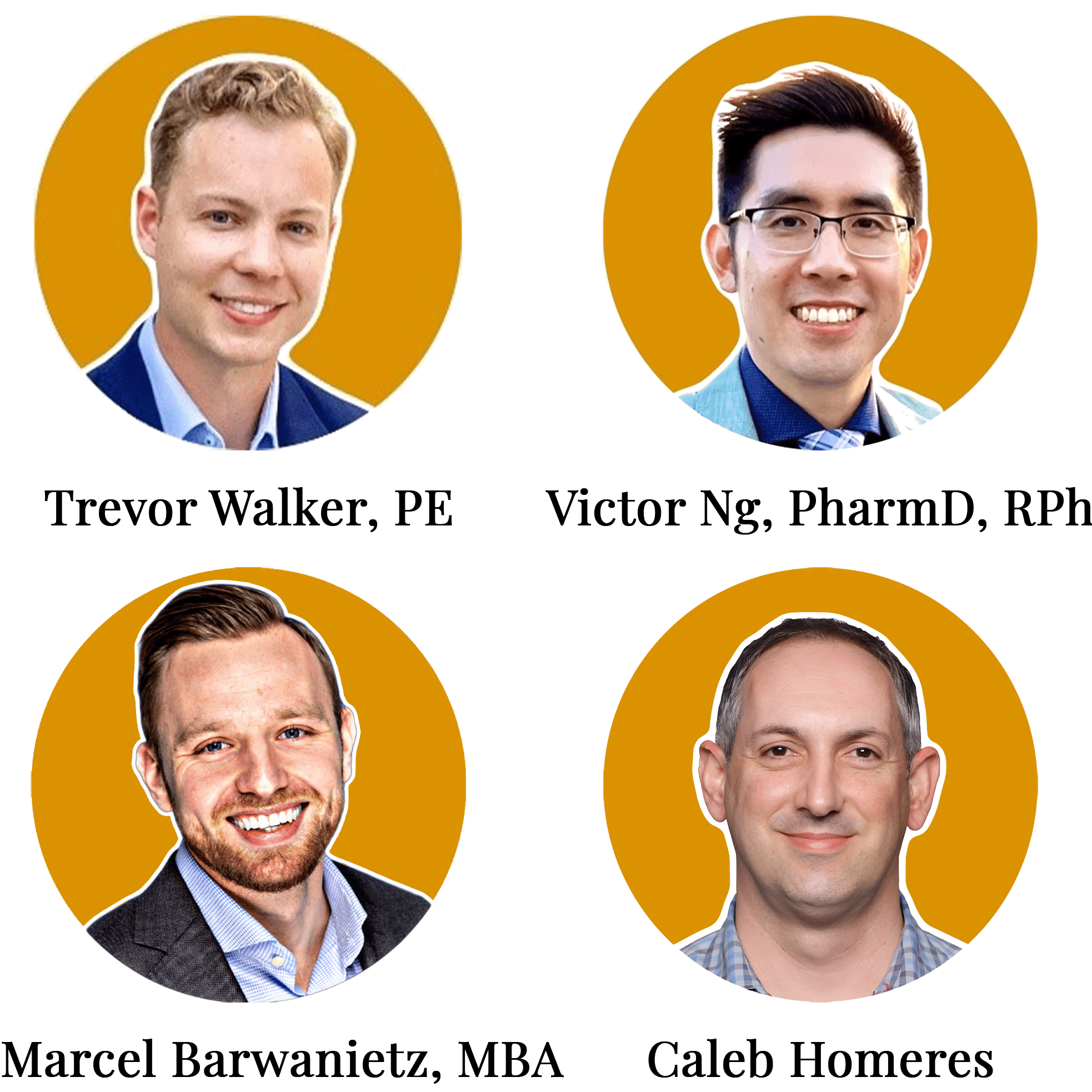

What’s the story of the Freedom Chasers? Marcel, Trevor, Victor, and Caleb are hard-working, family-loving professionals with a successful track record in the corporate world (engineering, automotive, pharmacy, professional sports). However, they realized their current path up the corporate ladder severely limited their ability to create the freedom for themselves, and other like-minded professionals navigating life’s challenges just like them. Inspired by their shared values, their desire to impact others, and their firm belief in the power of multifamily real estate investing, they started Freedom Chasers Capital. Marcel, Trevor, Victor, and Caleb are steadfastly committed to creating freedom for thousands of other hard-working, family-loving professionals through their investing opportunities. Ultimately, they believe that freedom isn’t just for freedom itself, but that freedom allows their investors to take more control of their time to spend it on what brings them meaning, purpose, and joy.

Core Values

We believe that core values are crucial for the growth and development of The Multifamily Freedom Chasers, and we stand by these values no matter the situation

Purpose

We have a clear sense of why we do what we do, and we are committed to fulfilling our vision.

Inspiration

We seek to inspire and motivate ourselves and others to achieve our highest potential.

Integrity

We act with honesty, fairness, and ethics in all our interactions and decisions.

Alignment

We align our actions as a team and partner with those sharing our core values.

Accountability

We take responsibility for our actions and are committed to delivering results.

Professionalism

We are dedicated to upholding a high standard of excellence and quality work.

Transparency

We value openness, transparency, and authenticity in all our actions and communication.

Teamwork

We are committed to working as a cohesive unit with our strategic partners to reach our goals.

Execution

We take action to implement our plans and achieve our objectives.

Impact

We strive to positively impact our investors, partners, and communities.

FAQ

While all investments have risks, passive investing multifamily real estate allows the investor, passive investing in multifamily real estate allows the investor access to the potential returns of real estate without the time commitment or expertise required for active management. A professional property management team handles all aspects of the property, including maintenance, leasing, and tenant relations, allowing investors to enjoy the passive income stream from their investment. Additionally, having ownership in multifamily properties can reduce the amount of taxes paid by the investor through strategies such as cost segregation and accelerated depreciation. Passive investing in multifamily real estate can also diversify an investor’s portfolio, reducing the overall risk of their investments. Overall, investing in multifamily real estate can be a compelling investment option for those seeking stable, long-term returns.

Typically, passive investors benefit from all the tax benefits related to owning real estate. For filing taxes, a document called a K1 will be supplied to you showing any income or losses on the investment which can be supplied to your CPA. Most of the time, a cost segregation analysis on the asset will be conducted in order to accelerate the depreciation of the property. This allows passive investors to claim these losses from the depreciation and offset the gains from their passive income. Each tax situation is unique. Be sure to discuss the tax advantages (or disadvantages) with your own tax professional that is evaluating your unique situation.

Once we have an executed contract to acquire an asset, our investors will be notified of an investment opportunity. The specifics of the deal will be communicated via phone calls and webinars, and those wanting to invest in the deal will be asked to issue a soft commitment. Once due diligence is completed, the PPM will be generated and to the investors to sign. After signing, the investors will transfer the funds and the Sponsor Team will close on the property.

We maintain sole discretion as to who we admit as investors. We only make offers to purchase securities through our PPM. Investors are not admitted until all documents are signed, the investment is remitted, and the Company approves and accepts the investors admission into the offering.

Every business plan for a multifamily acquisition will have its differences. However, we make it a priority to return the investors capital back to them as soon as reasonably possible. Based on rules of thumb and experience, we are looking to return investors’ capital between year 3 and year 5 of operating the asset, either through a refinance of the property or sale.

This is our anticipated plan, but numerous variables outside of our control can make this impractical or unfeasible. We maintain discretion to shorten or lengthen the hold time.

A sophisticated investor is an individual with investing experience and knowledge that allows them to make informed investment decisions without relying on regulatory protections. They may not meet the income or net worth requirements to be accredited, but are still considered to have a high level of financial knowledge. An accredited investor is an individual or entity that meets certain financial criteria, such as having a net worth of at least $1 million (excluding primary residence) or an annual income of at least $200,000 (or $300,000 for spouses and spousal equivalents) over the previous 2 years, with the expectation to continue those earnings moving forward.

Click the button below to schedule a call with our team and see how we can help you!

Read all of these disclosures and terms—they govern your terms of use for this Website. The Company, Freedom Chasers Capital LLC (the “Company” or “Freedom Chasers”) has the right change the contents herein at any time without advanced notice. When referencing the Company, it shall mean Freedom Chasers Capital LLC, its heirs, affiliates, children, parents, assigns, and similar parties. You are advised to review the Terms for any changes when you visit the website even if you have not received a notification of changes as you are bound by them even if you have not reviewed them. Your viewing and use of the website after such change constitutes your acceptance of the Terms and any changes to such terms. If at any time you do not want to be bound by the Terms you should logout, exit and cease using the website immediately.